Nearly two years after the Securities and Exchange Commission (SEC) proposed rules that would require publicly traded companies to provide climate-related disclosures, the agency issued its final rule on March 6, 2024. With a 3-2 vote, the SEC passed a pared down version of what was initially proposed in 2022. The final rule is an extension of the 2010 guidance that the agency published which outlined how their existing rules may require climate-related disclosures.

The rule is significant as it is the first time that they are requiring companies to report on greenhouse gas emissions and disclose climate-related information in SEC filings. The information that must be disclosed includes:

- Material Scope 1 (direct emissions) and Scope 2 (indirect emissions from electricity) greenhouse gas (GHG) emissions for Accelerated Filers (AF) and Large-Accelerated Filers (LAF)

- Material climate-related risks

- Actions taken by the company to address those risks

- Information on Board oversight and the responsibility of management for climate-related risks

- Climate-related targets or goals that are material to the company’s business

The SEC has added materiality qualifiers to most of the disclosures required under the new rule. These include disclosures on Scope 1 and Scope 2 GHG emissions, impacts of climate-related risks, and maintained internal carbon prices. Materiality refers to the significance of an issue to a company’s business strategy and its stakeholders. For example, water scarcity would be considered a material impact for a beverage company.

While most printing operations are not publicly traded, some are and will need to determine how this new rule will impact their SEC filings. The elimination of Scope 3 emissions provides significant relief for the printing industry, as any printing company would be in the supply chain of a covered company that would have to provide information on their Scope 1, 2 and 3 emissions to their customers. PRINTING United Alliance opposed the initial draft regulation and signed a coalition letter in opposition to the proposed rule. The Alliance agrees that the changes will reduce the burden imposed on covered companies.

Final Rule Requirements

The 866-page final rule is significantly scaled back from its original proposal because of intense backlash as indicated by the 24,000 comments received by the SEC, including around 8,100 received in the 72 hours leading to the final hearing. The following are some of the changes from the initial proposed rule:

- Elimination of Scope 3 disclosures: The SEC backed off from requiring Scope 3 GHG emissions. These are emissions from downstream and upstream activities in the company’s value chain.

- Scope 1 and Scope 2 disclosures are not required for all companies: Rather than a universal requirement for all companies to disclose GHG emissions, only large-accelerated filers (LAF) and accelerated filers (AF) will have to disclose. Smaller Reporting Companies (SRC) and Emerging Growth Companies (EGR) are exempt.

- Emissions disclosures can be filed on a delayed basis each year: Impacted issuers will be allowed to provide Scope 1 and Scope 2 GHG emissions disclosure in their second quarterly report to be filed after their fiscal year ends.

- Flexibility on placement: The initial proposal mandated inclusion of the attestation report and pertinent disclosures within a distinct "Climate-Related Disclosure" segment in the relevant filing. However, the final rule gives companies the flexibility to present these new disclosures either in a designated section or interspersed within existing sections of a registration statement or annual report.

- Modified risk disclosures: The final rule also modifies the disclosure of climate-related risks, removing the mention of adverse effects on a registrant’s value chain. Registrants can now assess whether climate-related impacts are material to their operation.

- Scaled-back governance disclosures: Companies are not obligated to disclose the expertise of board members, identify specific members responsible for climate-related risk, report the frequency of climate-related risk reporting to the board, or detail how the board establishes climate-related targets or goals. However, registrants must describe whether and how the board supervises progress against disclosed climate-related targets, goals, or transition plans.

Although these changes have alleviated some of the burden on public companies in comparison to the proposed rule, the new requirements are still expected to have a significant impact on company’s registration statements and annual reports.

Types of Filers

- Large Accelerated Filer (LAF) – A reporting company with a public float equal to or exceeding $700 million, determined as of last business day of the issuers most recently concluded second fiscal quarter.

- Accelerated Filer (AF) – A reporting company with a public float ranging from $75 million and $700 million that has a history of filing periodic reports for at least 12 months, has submitted at least one annual report, and is not an SRC.

- Smaller Reporting Company (SRC) - A reporting company that is not an investment company, an asset backed issuer, or majority owned subsidiary of a parent company that is not at SRC, has an annual revenue of less than $100 million, and has a public float below $700 million.

- Emerging Growth Company (EGC) - An issuer can elect to be an EGC during its process of going public and remains an ECG until it meets certain requirements.

- Non-Accelerated Filer (NAF) – A company that does not meet the requirements for LAF or AF.

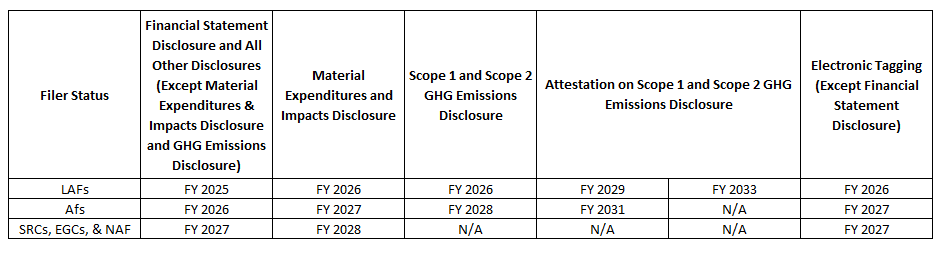

The final rule will become effective on May 6, 2024, and once effective, compliance dates will be phased in. The table below summarizes the timeline for compliance:

Legal Challenges

The final rule has come under intense criticism from both business and industry and nongovernment organizations for separate reasons. As of the date of this First-To-Know, nine lawsuits have been filed challenging the regulation. Eight of the lawsuits are challenging the legal authority of the SEC to issue the rule, as the SEC went beyond its mandate to protect the financial integrity of security exchanges and investors from fraud. They contend that the rule creates unnecessary burdens for businesses and forces them to reveal information that they may need to keep confidential. One of the lawsuits filed by an environmental group contends that the rule does not go far enough because it dropped the requirement to report on Scope 3 emissions. The Alliance will provide an update as the lawsuits are heard by the court.

Summary and Conclusion

As a result of these new reporting requirements, investors and other stakeholders can compare a company's disclosures yearly, monitor changes against previous commitments, and scrutinize alterations for signs of greenwashing. Companies may face accountability for inconsistencies between disclosures submitted to the SEC and statements made elsewhere. The SEC will likely increase scrutiny of environmental and climate impact statements in federal filings. Standardized disclosure requirements will enable the SEC to evaluate both affirmative statements and material omissions more effectively. Failure to comply with the new rule may result in fines and legal action from the SEC, erode market trust, impact stock prices, and trigger adverse investor reactions.

In this article, Sara Osorio, Coordinator, EHS Affairs, PRINTING United Alliance, reviews the SEC’s new climate related disclosures rule. More information about this and other sustainability issues can be found at Business Excellence-EHS Affairs, or reach out to Sara directly if you have questions about how these issues may affect your business: sosorio@printing.org.

To become a member of the Alliance and learn more about how our subject matter experts can assist your company with services and resources such as those mentioned in this article, please contact the Alliance membership team: 888-385-3588 / membership@printing.org.